idaho solar tax credit 2021

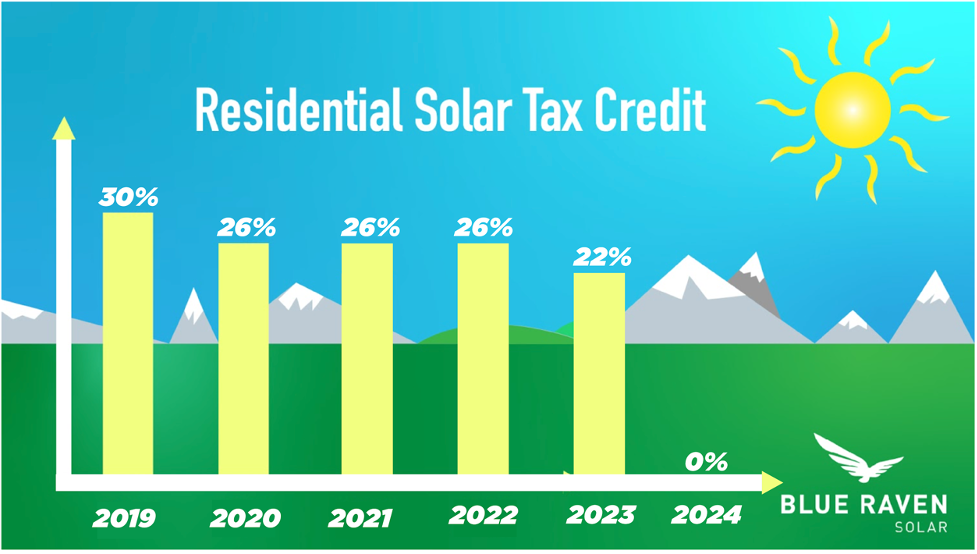

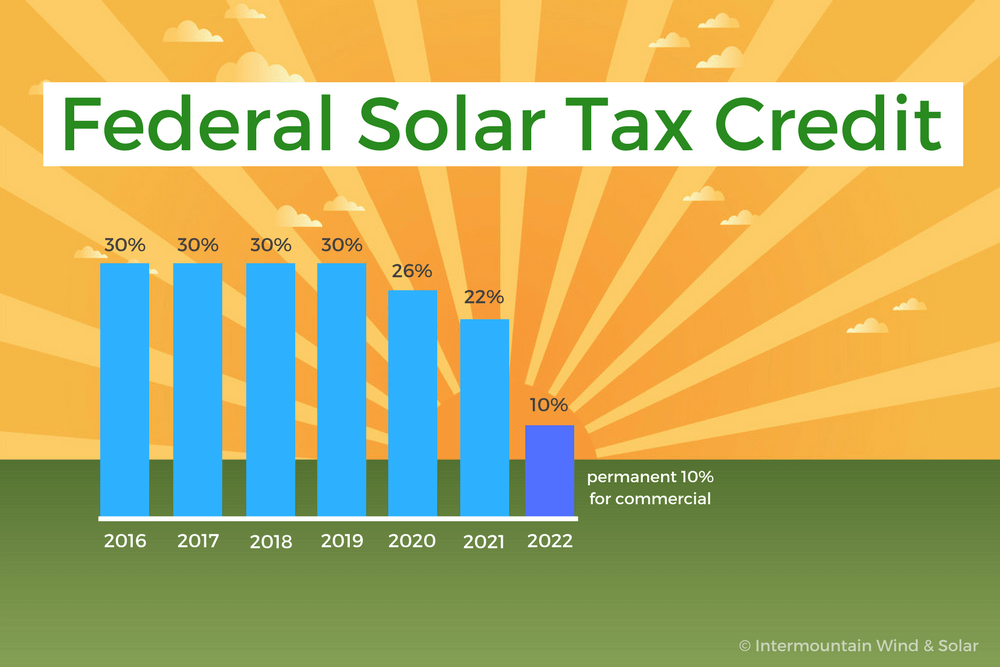

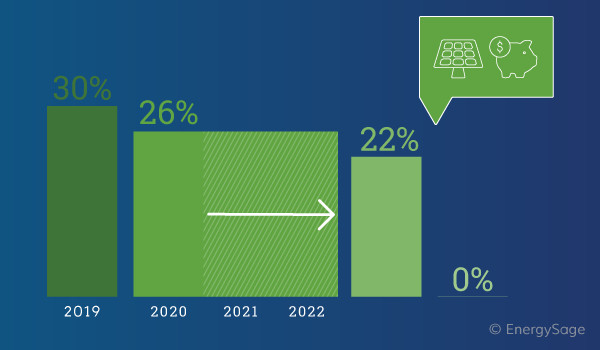

This is 26 off the entire cost of the system including equipment labor and permitting. The Federal tax credit decreases to 26 in 2020 then to 22 in 2021 and expires December 31 2021.

Frequently Asked Questions Idaho Power

Go solar today to take advantage of these incentives.

. These 20 agreements comply with the Public Utility Regulatory Policies Act PURPA which requires utilities like Idaho Power to buy all energy generated by certain facilities. Idaho State Energy Tax Credits. Learn more Shade Tree Project.

Forty percent 40 of the amount that is properly attributable to the construction reconstruction remodeling installation or. Installed and claimed in 2021 taxes at. Also some Idaho residents will receive a one-time tax rebate in 2021.

Solar photovoltaic projects American Falls Solar I and II were completed in 2017. Installed in 2016 this 108 MW projects generates enough electricity to power nearly 18000 homes. For example if your solar PV system was installed before December 31 2022 installation costs totaled 18000 and your state government gave you a one-time rebate of 1000 for installing the system your federal tax credit would be calculated as follows.

There will be no credit for small-scale solar by 2024. Taxpayers can apply this 40 deduction in the year in which the system is installed and can also deduct 20 of the cost each year for three years thereafter. Idaho Solar customers have the opportunity to take advantage of both the Federal Investment Tax Credit worth 30 of your system cost as well as the Idaho State Tax Credit of 1500.

With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent. The Federal Investment Tax Credit ITC is available to Idaho homeowners who purchase their solar panel system with cash or a loan. Its one of following whichever is greater.

The ITC for solar power projects which would have expired in 2020 will now remain at 26 for projects that begin construction in 2021 and 2022 be reduced to 22 in 2023 and decrease to 10 in 2024 for commercial size projects. The first year after installing your home PV system the Idaho solar tax credit allows you to deduct 40 percent of the cost of your photovoltaic power project when you file income taxes. See how much you can save on home solar panels through rebates tax credits in Idaho.

Wind projects started in either 2020 or 2021 will qualify for a production tax credit at 60 of the full rate on the electrical output for 10 years. The ITC for solar power projects which would have expired in 2020 will now remain at 26 for projects that begin construction in 2021 and 2022 be reduced to 22 in 2023 and decrease to 10 in 2024 for commercial size projects. Installed and claimed in 2019 taxes at the full 30 level your credit would be 8100.

Then for the next three years youll be eligible for a 20 percent state income tax deduction. And dont forget the Federal rebate for installed solar systems is 30. The federal tax credit falls to 22 at the end of 2022.

Tax credits for other technologies may be claimed at the full rate. The average cost for an installed residential solar system in Idaho is currently 11198 after claiming the 26 federal solar tax credit. We also have an agreement to purchase energy from the 120 MW.

Idahos income tax rates have been reduced. However there is some. The amount is based on the most recent approved 2020 tax return information on file at the time the rebate is issued.

This is one of many reasons why it makes sense to go solar. After accounting for the 26 Federal Investment Tax Credit ITC and other state and local solar incentives the net price youll pay for solar can fall by thousands of dollars. Keep in mind that the ITC applies only to those who buy their PV system outright either with a cash purchase or solar loan and that you must have enough income for the tax credit be meaningful.

Any insulation added must be in addition to not a. Solar panel cost by state Best current solar offers near you. Idaho offers state tax credits.

House Bill 317 Effective January 1 2021. The corporate income tax rate is now 65. Idaho residents with homes built or under construction before 2002 or who had a building permit issued before January 1 2002 qualify for an income tax deduction for 100 of the cost of installing new insulation or other approved energy efficiency improvements in an existing residence.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. Heres a quick example of the difference in credits in 2019 and 2021 for a 9 kW solar array at an average cost of 27000. This is 252 per watt.

Grandview PV Solar Two is among the largest solar projects in Idaho. The federal solar tax credit. Calculate solar cost for your home Cost.

You can claim the credit for your primary residence vacation home and for either an existing structure or new construction. So altogether you can save up to 20000 through the Idaho. Earn 5 per month bill credit when you allow us to cycle your air conditioner on a few afternoons in June July August and September.

Its not available if you lease the system. Installed residential systems Avg. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income.

Given a solar panel system size of 5 kilowatts kW an average solar installation in Idaho ranges in cost from 11688 to 15812 with the average gross price for solar in Idaho coming in at 13750. For individual income tax rates now range from 1 to 65 and the number of tax brackets dropped from seven to five. Lower tax rates tax rebate.

This statute allows taxpayers an income tax deduction of 40 of the cost of a solar wind geothermal and certain biomass energy devices used for heating or electricity generation. Electricty Kilowatt Hour Tax. E911 - Prepaid Wireless Fee.

This credit currently amounts to 26 of your solar systems cost. Each year the maximum deduction is 5000. Heres the full list of federal.

1 An individual taxpayer who installs an alternative energy device to serve a place of residence of the individual taxpayer in the state of Idaho may deduct from taxable income the following amounts actually paid or accrued by the individual taxpayer. Combined the projects have a capacity of 52 MW and will generate enough electricity to power. Idaho Power has contracts with 20 commercial solar-energy projects that have a combined capacity of 319 MW.

Solar power prices savings and payback in your part of Idaho. 75 per taxpayer and each dependent. Dont forget about federal solar incentives.

Fuels Taxes and Fees. 12 of the tax amount reported on Form 40 line 20 or line 42 for eligible service members using Form 43. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200.

In 2023 the tax credits for installations will drop to 22.

Solar Panels For Idaho Homes Tax Incentives Prices Savings

Solar Power In Idaho Solar Tax Credit Rebates Savings

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Solar Panels For Idaho Homes Tax Incentives Prices Savings

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Big News For Solar In 2021 The Solar Investment Tax Credit Has Been Extended Blue Raven Solar

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Solar Panels For Idaho Homes Tax Incentives Prices Savings

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

How Much A Solar Roof Really Costs In 2021 21oak

How Does The Solar Tax Credit Work In Idaho Iws

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Solar Panels For Idaho Homes Tax Incentives Prices Savings

Solar Tax Exemptions Sales Tax And Property Tax 2022

How Does The Solar Tax Credit Work In Idaho Iws

Is Solar Worth It In My State Solar Panels Costs And Savings Solar Website

When Does The Federal Solar Tax Credit Expire Iws

Idaho Solar Panel Installers 2022 Id Solar Power Rebates Incentives Credits

Idaho Solar Panel Installers 2022 Id Solar Power Rebates Incentives Credits